richmond property tax calculator

The average effective property tax rate in. Please note that we can only.

Taxing Property Instead Of Income In B C

It is one of the most populous cities in Virginia.

. Electronic Check ACHEFT 095. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Richmond County. General Correspondence 1317 Eugene Heimann Circle Richmond TX 77469-3623.

Property Taxes Due 2021 property tax bills were due as of November 15 2021. The median property tax in Richmond County North Carolina is 732 per year for a home worth the median value of 71300. Mailing Contact Information.

Under the state Code reexaminations must occur at least once within a three-year timeframe. Richmond County New York Property Tax Go To Different County 284200 Avg. This tool is not designed for use with multi-residential.

For comparison the median home value in Richmond County is. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being. Real Estate and Personal Property Taxes Online Payment.

2022 Tax Digest and Levy 5-Year History. Your final property tax amount is calculated by multiplying the Richmond Hill final property tax rate for the year by the MPAC property assessed value. The citys average effective property tax rate is 111 among the 20 highest in Virginia.

Box 4277 Houston TX 77210-4277. Our Richmond County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax. City of Richmond Hill Property Tax.

062 of home value Yearly median tax in Richmond County The median property tax in Richmond County. The Mayor and Council of the City of Richmond Hill do hereby announce that. Richmond County collects on average 103 of a propertys.

105 of home value Yearly median tax in Richmond City The median property tax in Richmond City Virginia is. Richmond City Virginia Property Tax Go To Different County 212600 Avg. This property tax calculator is intended to be used by residential property owners to obtain an estimate of their property taxes by year.

The City Assessor determines the FMV of over 70000 real property parcels each year. The real estate tax is the result of multiplying the FMV of the property times the real estate tax rate. 295 with a minimum of 100.

These documents are provided in Adobe Acrobat PDF format for printing. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. For all who owned property on January 1 even if the property has been sold a tax bill will still be.

The current millage rate is 4132. You can calculate your property tax. Submit Tax Payments PO.

A 10 yearly tax hike is the maximum raise allowed on the capped properties. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address.

For comparison the median home value in Richmond County is.

Richmond Va Cost Of Living 2022 Is Richmond Va Affordable Data Tips Info

Property Tax By County Property Tax Calculator Rethority

Tax Bill Information Macomb Mi

Property Tax By County Property Tax Calculator Rethority

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

About Your Tax Bill City Of Richmond Hill

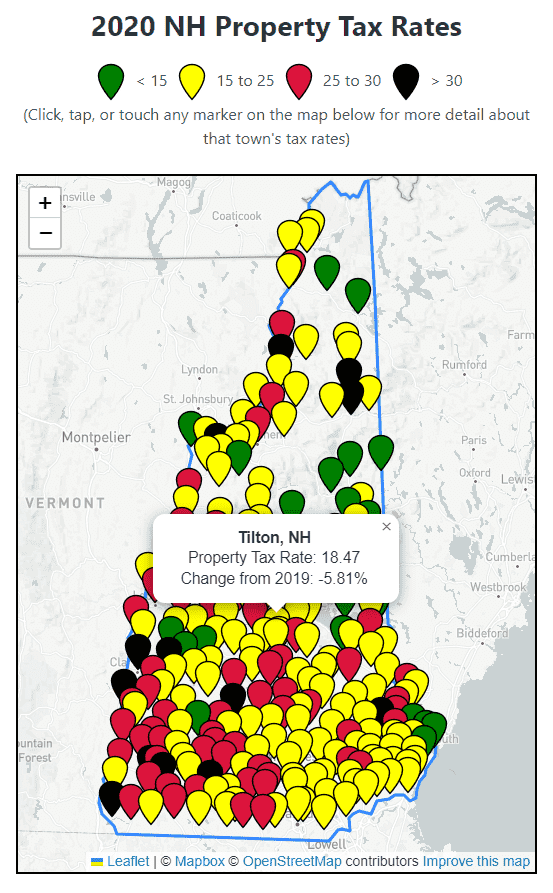

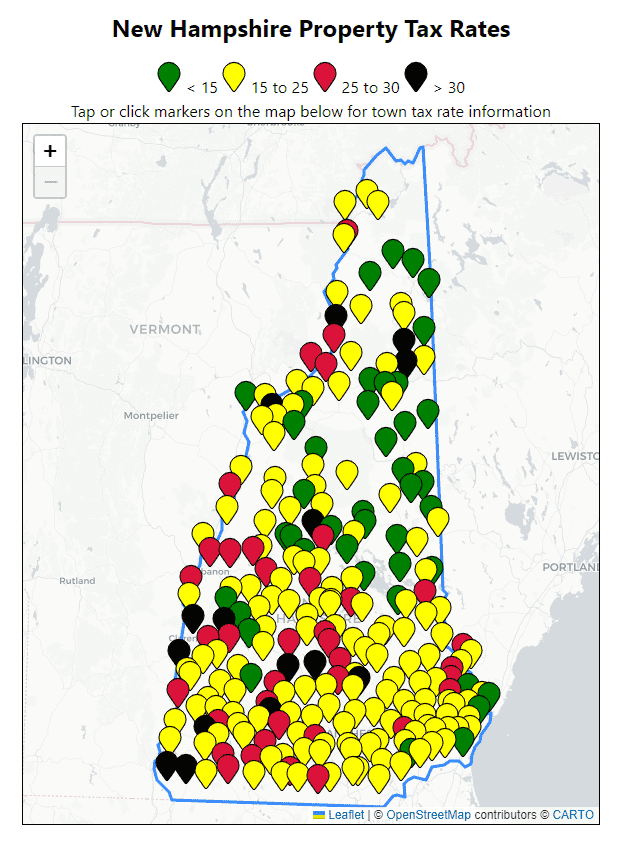

2020 New Hampshire Property Tax Rates Nh Town Property Taxes

Augusta Metro Area Property Taxes Below U S Average But Richmond County Is Right On The Line

All Current New Hampshire Property Tax Rates And Estimated Home Values

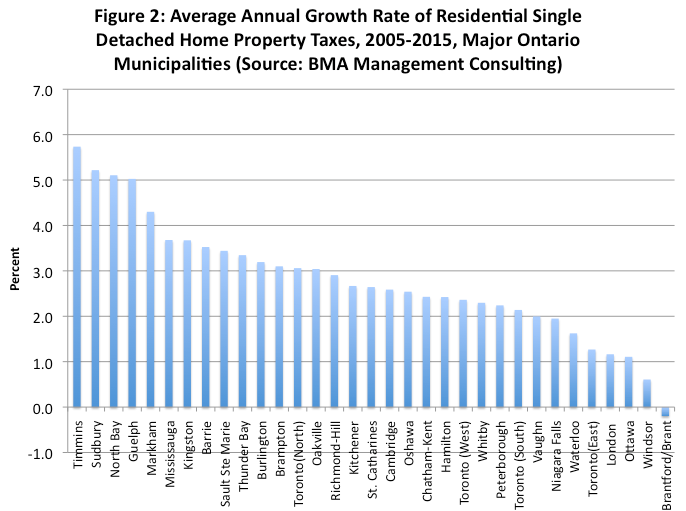

Ontarians Face Growing Property Tax Burden In Many Municipalities Fraser Institute

Property Taxes In Texas This Is How To Check How Much You Re Paying Where Your Money Is Going Your Proposed Rate

Nyc Residential Property Tax Guide For Class 2 Properties

Ontario Property Tax Rates Lowest And Highest Cities

Houston Property Tax Rates By Cutmytaxes Issuu

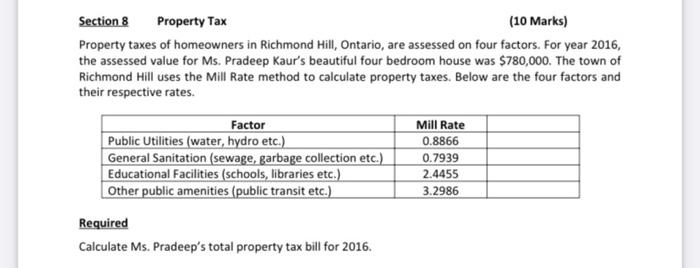

Solved Section 8 Property Tax 10 Marks Property Taxes Of Chegg Com

Sales Tax Increase In Central Virginia Region Beginning Oct 1 2020 Virginia Tax

Issue 1 The New York City Property Tax System Discriminates Against Residents Of Majority Minority Neighborhoods Tax Equity Now